Select a publicly held company and analyze its capital-structure

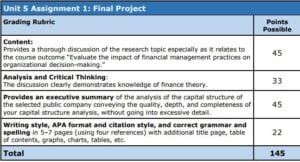

GB550 Financial Management Final Project Rubric

Here is a Rubric for your final Paper. It should be at least 1500 words (5-7 pages), not counting titles, abstract, references, table of contents, charts, balance sheets and extensive quotes.

Select a publicly held company and analyze its capital-structure, applying the theories and principles found in Chapter 15 of the text.

You must cover topics 1-5. You must include an abstract, table of contents, references.

Organize your work under following headings. Include interior titles (and include sub-headings under #5 a-f)

1. Title Page

2. Abstract. – Complete yet concise, at least 200 words, the abstract should be at least 200 words for a detailed description. If you go well over 200 words, as long as it is good content and adds to the material, I have no issues and it will most likely improve the grade by showing extra effort. Research papers, theses and dissertations include an abstract—a short, concise summary of your research. The abstract should include the keywords of your research. An abstract generally emphasizes, objective, the methodology, the main findings and conclusions of the research study. Articulate the research problem, and objective of the research. Include Keywords. Indicate the methodology.

3. Table of Contents.a one page detail of the topics and subtopics. The more detailed the number of topic subheadings listed the more thought you have provided to this paper. A very brief outline will receive a deduction.

4. Business and Financial Risks: Business and financial risks related to capital-structure such as operating risks, leverage and debt risks. A company’s business risk is the risk of the firm’s assets when no debt is used. Business risk is the risk inherent in the company’s operations. Some of those factors are as follows: Sales risk – Sales risk is affected by demand for the company’s product as well as the price per unit of the product. Input-cost risk – Input-cost risk is the volatility of the inputs into a company’s product as well as the company’s ability to change pricing if input costs change.

5. Modigliani and Miller’s [MM] capital-structure theory.

6. Criticisms of the MM model and assumptions.

7. A preview of capital structure issues. Capital-structure evidence: Capital-structure evidence and implications and problems with other Capital Structure Theories.

8. Estimating Optimal Capital Structure:

Estimating your firm’s optimal capital-structure. A firm’s optimal capital structure is that mix of debt and equity that maximizes the stock price.

a. Discuss the following and relate it to the optimal structure:

b. Business risk. Business risk is the riskiness inherent in the firm’s operations if it uses no debt.

c. Tax position.

d. Need for financial flexibility.

e. Managerial conservativeness.

f. Growth opportunities.

9. Reference list: A minimum of four references are required, excluding the textbook. Sources should be from academic, scholarly reviewed journals. You can not use your textbook or any other non-scholarly material as a graded reference.

What is a scholarly publication or reference? It is generally a white paper, original research but most typically a Journal article. No, not the Wall Street Journal, that is a business publication.

Solution preview

The capital structure is the way in which firms are able to have their operations financed and, therefore, have their businesses kept in operation and meeting the needs of the customers. Financing of a firm can happen through the acquisition of debt, financing though equity or through the application of both methods…………………………

APA

2736 words